Who we are

Winterflood Securities is number 1 in the UK Equity market* providing liquidity and flexible execution services to a diverse client network including institutional investors, retail brokers and asset managers.

Winterflood Securities is a leading liquidity provider

We are committed to making two-way prices even in extreme adverse market conditions. It is our belief that technology-led innovation is a solid path to the development of our company. At Winterflood we pride ourselves on being client-centric and aim to provide our customers with a flexible, high-quality service through the entire execution cycle from pre-trade right through to settlement.

We believe you are only as good as your last trade, and want to forge long-term trusted relationships that support customer needs with innovation and consistently reliable service.

*For more information regarding the source of this information, please refer to the statements.

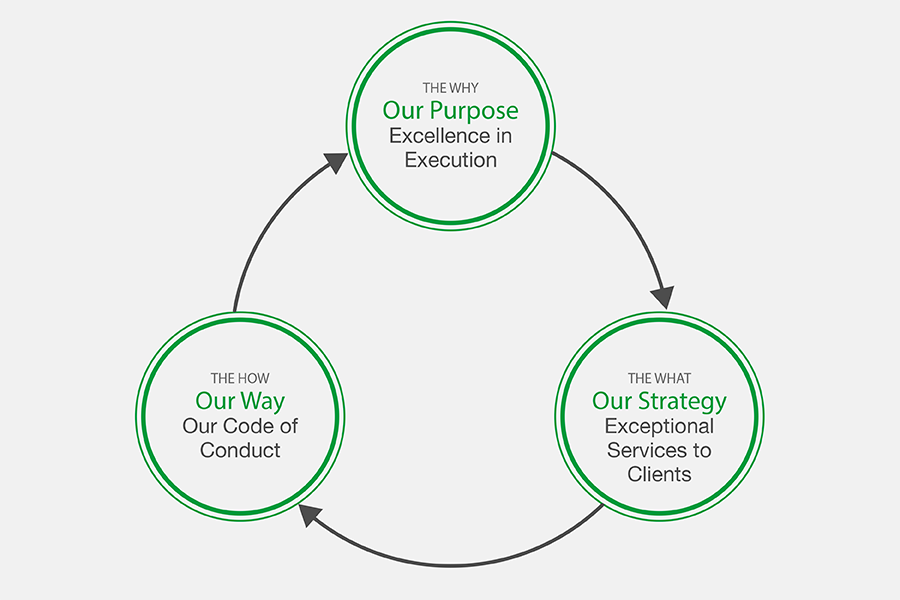

Our culture

Our culture is extremely important to us, it is what makes our firm truly unique, the ‘how’ we do what we do. So much so that we have explained and defined our culture in Our Way (our code of conduct) so we all remain unified in the understanding of our approach; "the why", "the what" and "the how" we do what we do from the moment we join the team.

Our Way is entwined in our people processes and is at the heart of the employee lifecycle, we attract, recruit, assess, develop and reward our people in line with their adherence to the performance and behaviours it defines. In the same way that we make markets by bridging between buyers and sellers, we bring together high calibre financial and technology specialists by providing an environment that helps cultivate innovation, promote collaboration and enables excellence to flourish.

We recognise that our culture continues to evolve as we grow, enabling us to be the best we can be in achieving our purpose. That’s why we are committed to our diversity & inclusion initiatives, we want our team to evolve to be as diverse as the client network we serve, but we have to be realistic, due to the nature of our firm this will take time. We recognise as a firm renowned for growing our own talent which prides itself on our people’s experience & long service history, it may take longer for us to authentically reach diversity targets at senior levels.

Board of Directors

Bradley Dyer

Chief Executive Officer (CEO)

Bradley worked at both James Capel & HSBC in the late eighties and later joined WestLB Panmure and WestLB Equity Capital Markets in 1997. He was mainly based at WestLB Panmure in London but also spent time in both New York & Dusseldorf office locations trading European & US Equities as an Executive Director.

He joined Winterflood Securities in 2004 as a Senior Dealer. He was appointed to the role of Associate Director in 2014 and later appointed to the Board as Director of FTSE 350 & International Trading in 2017 overseeing Institutional & Retail Sales Trading, FTSE 350, Pan European & US Domestic Equity Markets.

In 2018, Bradley was appointed to Director & Head of Trading, with overall responsibility for trading across all sectors. In April 2022, Bradley was promoted to Managing Director, and then appointed CEO in September 2022.

Simon Rafferty FCA MCSI

Chief Finance Officer (CFO)

Simon qualified as a Chartered Accountant in 1997. In 1998, he joined Deloitte LLP to work in the Financial Services practice. He joined the finance team at Winterflood Securities in 2000 and in 2003 he became Financial Controller and Company Secretary. Then he was appointed to Head of Compliance in 2005 and was promoted to Director in 2012.

Matt Wilkinson

Director & Head of Trading

Matt Wilkinson joined Winterflood Securities as a Corporate Actions Clerk in 1997. Matt later became a Small Cap Dealer in 2001 before becoming a Senior Dealer for AIM in 2005. He was later appointed to the role of Associate Director in 2014 and became Head of AIM in 2018.

In 2019, Matt was appointed to Director & Deputy Head of Trading. In September 2022, Matt was promoted to Director & Head of Trading.

Grant Davidson MBA

Chief Operating Officer (COO)

Grant joined Winterflood Securities in 2004 having previously worked as a specialist IT consultant within both financial and legal businesses in London. During this time, he completed an MBA in 2008 which has allowed him to better align the IT strategy to the overall business plan. In 2010 he was promoted to oversee the IT function. He was later promoted to an Associate Director in January 2014 and then to the board as a Director in August 2015.

Joe Winkley

Director & Head of Investment Trusts

Joe Winkley became a Director & Head of Investment Trusts at Winterflood Securities in September 2018. He joined the firm in 2013 as the Head of Corporate Finance to advise 54 investment companies and was responsible for all listed fund transactions including IPOs, issuance and corporate advisory. Joe has nearly 20 years’ experience in investment funds and has advised on over £10bn of fundraising. Joe previously worked at Oriel, UBS, Dresdner Kleinwort, and Slaughter and May, where he qualified as a solicitor.

Alex Kerry

Director & Head of Winterflood Business Services

Alex has over 20 years’ experience working in Financial Services leadership roles across a number of sectors including Treasury, Wholesale and Wealth Management. Alex joined Winterflood Securities in 2010 where he was instrumental in establishing Winterflood Business Services, becoming the Head of WBS in 2014. Prior to that he worked for Barclays Wealth optimising the operations area and control functions of the businesses in London initially, then the Channel Islands, Cyprus, Gibraltar and the Cayman Islands. Alex previously worked at Citigroup working on new Client Implementations and Motorola Inc in Corporate Treasury. Alex was appointed to the board as a Director in 2019.

James Stapleton Chartered MCSI

Director & Head of Compliance

James joined Winterflood in 2007 having been seconded to the firm to implement MiFID. James started his career at Deloitte LLP as a graduate trainee in the Regulatory Consulting team, working with a range of companies across insurance, life and pensions, banking and investment business. James was promoted to Head of Compliance in 2013 and was later appointed Company Secretary. James is a Chartered MCSI and in 2015 was awarded the CISI Outstanding Compliance Professional Award. James was appointed to the Board in 2020.

Rebekah Coughlan

Director & Head of Human Resources

Rebekah joined Winterflood Securities in 2005 as an Executive Assistant for the incumbent CEO. She transferred to Personnel in 2006, working initially as a sole practitioner, promoted to Head of HR on establishment of the Human Resources function and completion of her Human Resource Management Masters in 2009. Rebekah was appointed to the board as a Director in 2022.

Prior to that Rebekah started her professional career at South Bank Systems (acquired by Precisely) and holds a degree in Forensic Science.

Our other business lines

Winterflood Securities is a wholly-owned subsidiary of Close Brothers Group plc.

Close Brothers is a leading UK merchant banking group providing lending, deposit taking, wealth management services, and securities trading. The group employs over 3,700 people, principally in the UK. Close Brothers Group plc is listed on the London Stock Exchange and is a member of the FTSE 250.