A powerful blend of people and technology

Get the best of both worlds from our team's ability to anticipate, originate and exploit technological advances matched with market experience, regulatory knowledge and outstanding client service.

Rely on Winterflood's expertise, outstanding technology and unique liquidity.

Source: Bloomberg <RANK>, used with permission of Bloomberg Finance L.P.

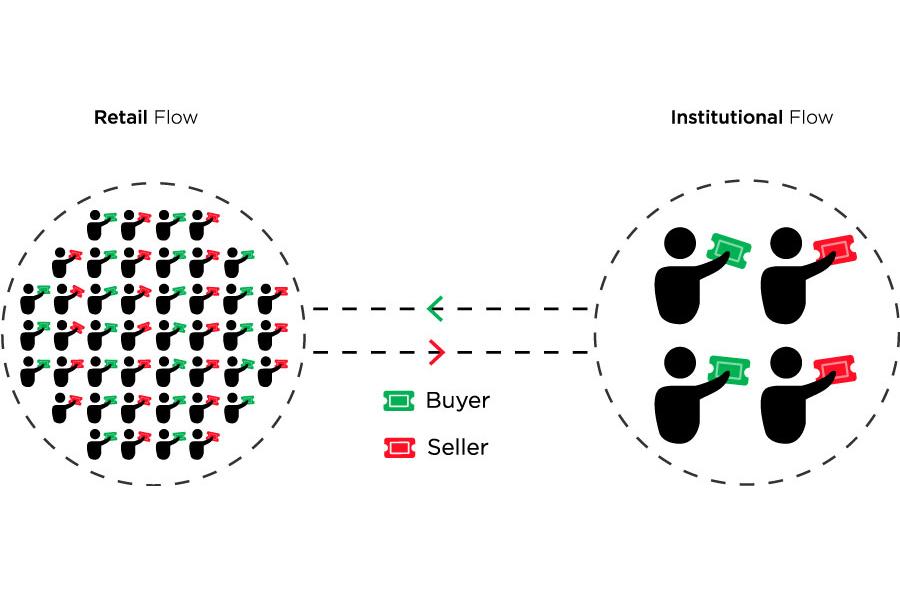

Get access to a unique liquidity proposition resulting from Winterflood’s ability to consolidate both institutional and retail flow coming from a diverse client base. This exceptional blend of liquidity, in addition to Winterflood’s own liquidity, helps both retail and institutional-sized orders achieve best execution, frequently at a more competitive price than elsewhere in the market.

“94% of our client order flow is captured and executed electronically.”

Get the best of both worlds from our team's ability to anticipate, originate and exploit technological advances matched with market experience, regulatory knowledge and outstanding client service.

Our 70 traders have an average of 15 years experience, so have weathered market highs, lows and turbulence. Our reputation for service and the scalability and ease of Winterflood’s trading platform provides effective tools for different order sizes and types of client from all aspects of the securities sector. including:

Get seamless access to pan-European and North American markets via our cutting-edge electronic trading platforms, using Winterflood's proprietary state of the art technology, through one single connection. Choose from several connectivity options to suit your business needs.

Winner

With executions priced at the market price or better thanks to our in-house liquidity, use Winterflood’s proprietary technology and dealing service for equities, ETPs, fixed income and investment trusts. Receive one consolidated fill, typically 86.54%* with price and liquidity improvement, yielding significant reductions in transaction fees compared with exchange, clearing and settlement fees associated with executing smaller orders via DMA/SOR on order books.

Source: LiquidMetrix, Oct-Dec 2020

Win-X

Access our highly-experienced team of sales traders for working more complex care orders with minimal market impact. In addition to a diverse range of liquidity sources, the sales traders facilitate interaction with our vast retail order-flow. Win-X also enables access to our sophisticated smart order router and algorithms allowing direct strategic access (DSA) to the leading exchanges and MTF’s.

Contact us for more information