Securities Coverage

Sales trading & asset classes

Get access to over 15,500 tradable instruments including UK and international equities, fixed income, ETPs, investment trusts and other key asset classes.

Sales trading & asset classes

Danny Want - Head of Institutional Sales Trading

75417

Lindsey Sparling - Head of Specialised Sales & Execution

66666, 66667

Use the services of the UK’s #1 market maker in London*

Registered in over 3300 instruments on the London Stock Exchange (LSE website, January 2021)

Winterflood’s success has been built on its execution and distribution capabilities in UK equities covering:

*Source: www.winterflood.com/statements

Mark Bumstead - Head of AIM

75414, 75415, 75416

Dominic Sullivan - Head of FTSE 350

70422

Rory Meecham - Head of Small Cap Trading

75414, 75415, 75416

Reduce the complexities of trading internationally by using a single platform matched by full broker service if needed. We can help you with:

Joe Roulland - Head of International Trading

+44(0)20 3100 0560 +44(0)20 3100 0550

euro@winterflood.com us@winterflood.com

STX 75400 STX 75430

Since 1995, our experienced fixed income trading team has been offering wholesale and retail liquidity to our diverse list of wealth managers, small institutions and retail intermediaries. Winterflood’s market-making and trading desk provides extensive coverage in the secondary market of sterling corporate bonds and UK Gilts. Together with our Debt Capital Markets team, Winterflood offers a one-stop shop including origination, distribution, settlement, market-making and post-issuance liability management.

Winterflood’s Fixed Income market-making desk is:

Winterflood’s Debt Capital Markets team comprises of individuals who have extensive experience of the UK’s wholesale and retail-enabled listed bond markets. Members of our team have originated, structured and placed retail-enabled listed bonds for debut issuers and established corporate borrowers since the 2011.

The UK’s listing rules are likely to change during 2024 with the intention of making it easier for bond issuers to use low denominations that are more suitable for wealth managers and retail investors. Winterflood’s unique proposition has always been to provide liquidity, distribution and service to wealth managers and retail investors via their intermediary brokers. We are therefore naturally positioned to support issuers who want to benefit from extending the distribution of their bonds to a segment of the market that has been excluded both in the primary and secondary markets.

If you would like to know more about how the changes could be of benefit to your business then please reach out to Winterflood Debt Capital Markets. Read our White Paper here which explains the coming changes.

Will Boddy - Head of Fixed Income Trading

Michael Smith - CFA, Debt Capital Markets

+44 (0)20 3100 0803

Bloomberg: WINX

75411, 75402, 75429

As a client you can expect innovative products in our wide range of exchange traded funds and exchange traded commodities. Winterflood’s friendly and knowledgeable ETP team are well placed to provide:

Matthew Lee - Head of Exchange Traded Products

76755

Winterflood investment trusts provides full-service broking support to its clients including:

Matthew Wilson - Head of Investment Trusts Sales

Ben Fuller - Head of Investment Trusts Market Making

75410

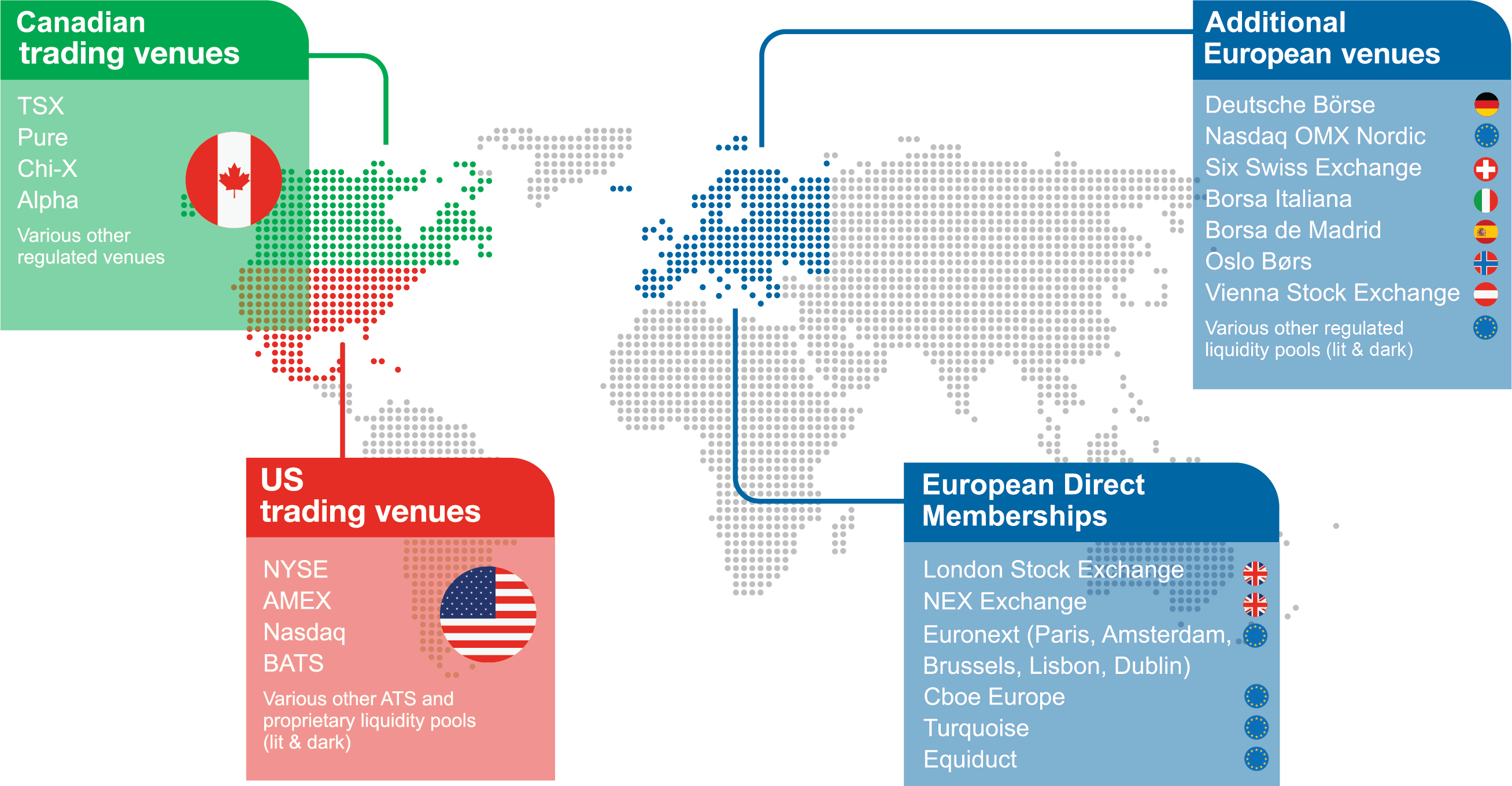

Access to Global Pools of Liquidity